Whether you’re selling a house or a hamster, pricing matters. What follows are five key considerations to keep in mind so that you can leverage your pricing strategy to maximize sales.

Consideration 1: Say the price

Confusion kills a sale. This applies as much to the marketing copy for your product or service as it does to your pricing. If you’re communicating verbally, the fewer syllables the better. In other words, the shorter your price, the more likely your customer will understand what you tell them. i.e. ‘fifteen hundred’ is a better way to convey price than ‘one thousand, five hundred.’(1)

If you have pricing on a website or in a written contract, you may or may not want to include commas and cents depending on how you want the price to be perceived by your customers (see below for more on why). Omit commas (eg $1500) if you would like the price to appear smaller. Add them in, along with cents, if you would like to convey a high price (eg $1,499.97). (2)

Consideration 2: Pattern Recognition in Nines & Conversion Rates

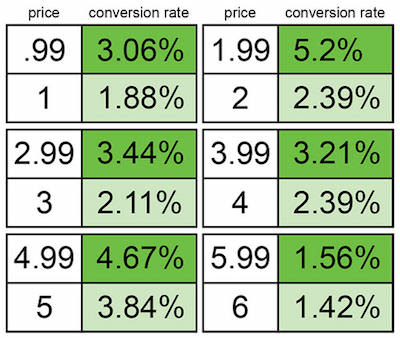

Check out this table of Gumroad’s sales:

Source: Gumroad

Source: Gumroad

When people see those positive results, they often credit the 9’s in the price ($1.99). However, there’s another culprit responsible: the left digit. Changing the dollar amount is perceived as a magnitude change, even when it’s not. A one-cent difference between $6.60 and $6.59 won’t matter. However, a one-cent difference between $5.00 and $4.99 will make a huge difference.

Why? Pattern recognition. One whole number is a different pattern, whether smaller or larger. In the Journal of Consumer Research, authors Thomas and Morwitz explain:

“…while evaluating “2.99,” the magnitude encoding process starts as soon as our eyes encounter the digit “2.” Consequently, the encoded magnitude of $2.99 gets anchored on the leftmost digit (i.e., $2) and becomes significantly lower than the encoded magnitude of $3.00.” (pp. 55)

The numerical cognition literature (3) suggests that numerical stimuli (read: prices) are represented and encoded in memory as magnitude representations, i.e., judgments of relative “size.” Price your products or services such that your customer is inclined to perceive a lower price and higher value (eg $197 instead of $200) to improve the likelihood of purchase.

Consideration 3: Disaggregate pricing.

If you sell products online, consider whether or not shipping and handling fees ought to be seperate. Or whether components of your product or service should be bundled or sold a la carte.

“Partitioned pricing” is the strategy of breaking up the total cost into multiple components. Partitioned pricing anchors customers to the base price, rather than the total cost. This means that when customers compare your price to a reference price, they’ll be more likely to pull your base price into the comparison.

For example, say someone is shopping for a computer. You happen to sell a base model that costs $899. But you offer upgrades (graphics card, hard-drive storage, lights behind the keyboard, color options, monogramming, custom covers, etc, etc) and expedited shipping options that can boost the total cost up to $2,500. Meanwhile, your competitor offers the top-of-the-line upgraded model as a package for $1,899. Technically, yours is more expensive by $600, but you’ve anchored the customer to a reasonable price point by comparison ($899). They’re thus more likely to purchase from you (5, 6).

Consideration 4: Financing

Some services and products are expensive. Houses come to mind, along with cars, mattresses, home remodels, etc.

If you sell a product or service that rides a fine line between price points, or that is simply expensive by nature, it’s worth considering offering a financing option. If your service costs $10,000 from onboard to completion, you might offer “24 easy payments of $419!”.

This brings up another aspect of financing: providing a subscription model. These models may go for an un-predetermined amount of time, or run for six months, a year, 18 months… If you provide an app or software, rather than asking customers to pay $500 up front, they might pay $19.95 each month they want to access the service. Assuming, of course, the service is one used over a long period of time.

Bonus points if your service has an auto-renewal option. Costco has been in the midst of a campaign getting members to enroll in auto-renewal, ostensibly to minimize loss of subscriptions from folks re-evaluating their spending when their memberships are up.

The easier your product or service fits into your target customers budget and then falls off their radar, the more likely you’ll make and keep the recurring sale.

Consideration 5: Specificity of Pricing

In direct contradiction to our first consideration (keep the numbers simple and syllables low), it’s worth getting ultra specific if you’re selling big ticket items (7,8). After analyzing 27,000 real estate transactions, researchers found that when the numbers were highly specific, buyers were willing to pay more money.

Robert Cialdini also notes this effect in his book Influence. He chalks it up to two things. One, humans tend to want to trust other humans. Two, when there’s a high degree of specificity in price, we assume there’s a reason. Why else would a house cost $662,978 rather than $650,000? Well, it must be because of the addition of the upgraded appliances, new hardwood floors, and freshly re-finished kitchen cabinetry. Worth the extra couple thousand bucks, no?

Cited Resources and Additional Reading

(1) Dehaene & Stanislas, Numerical Cognition. The Journal of Cognition, Volume 44, Issues 1–2, 1992, pp1-42

(2) Coulter, K.S., Choi, P., Monore, K.B. Comma N’ cents in pricing: The effects of auditory representation encoding on price magnitude perceptions. Journal of Consumer Psychology, Volume 22, Issue 3, 2012, pp 395-407.

(3) Thomas, M., Morwitz, V. Penny Wide and Pound Foolish: The Left-Digit Effect in Price Cognition. Journal of Consumer Research, Vol. 32, No. 1. 2005. pp. 54-64.

(4) Coulter, K., Coulter, R. Size Does Matter: The Effects of Magnitude Representation Congruency on Price Perceptions Purchase Likelihood. University of Connecticut.

(5) Morwitz, V.G., Greenleaf, E.A., Johnson, E.J. Divide and Prosper: Consumers’ Reactions to Partitioned Prices. Journal of Marketing Research. 1998. pp. 453-463

(6) Hossain, T. & Morgan, J. Advances in Economic Analysis & Policy, 2006.

(7) Thomas, M., Simon, D.H., Vrinda, K. Do Consumers Perceive Precise Prices to be Lower than Round Prices? Evidence from Laboratory and Market Data. Johnson School Research Paper Series #09-07. Cornell University, The Johnson School, 2007.

(8) Robert Cialdini. Influence. 1984.